Recognizing the Refine and Benefits of Offshore Service Development

Checking out the realm of overseas organization formation provides fascinating strategic benefits for entrepreneurs, consisting of possible tax obligation advantages, privacy, and accessibility to international markets. The initial action in this trip involves selecting a proper jurisdiction, which calls for a mindful assessment of legal structures and financial stability. While the attraction of operational adaptability and monetary incentives is engaging, potential company owner have to also take into consideration the complexities of worldwide regulations and guidelines. This complex equilibrium of difficulties and advantages welcomes further expedition into the subtleties of establishing an offshore firm (Offshore Business Formation).

Picking the Right Jurisdiction for Your Offshore Firm

When picking a territory for an overseas firm, it is vital to consider lawful, financial, and functional aspects. Each territory provides distinct advantages and challenges, which can significantly impact the success and efficiency of an overseas entity. Financial considerations frequently control the decision-making process, as potential tax benefits are a key incentive for overseas consolidation. Different jurisdictions provide varying degrees of tax incentives, from minimized prices to complete tax obligation exemptions.

Functional aspects likewise play a critical function. These include the simplicity of firm configuration, the accessibility of specialist services, and the general service environment. Some territories boast sophisticated financial services industries with a riches of competence in supporting offshore firms (Offshore Business Formation). Others may offer more personal privacy but less support framework. Business owners must balance these facets to select the most ideal place for their company needs, guaranteeing that the territory lines up with their critical objectives and long-lasting objectives.

Legal and Governing Considerations in Offshore Unification

Recognizing these nuances is crucial to stay clear of lawful challenges and charges. Companies need to likewise remain aware of worldwide policies, such as the Foreign Account Tax Obligation Compliance Act (FATCA) in the USA, which impacts exactly how offshore financial accounts and entities report to more the IRS.

Strategic Benefits of Developing an Offshore Service

Additionally, accessing international markets becomes more feasible with an overseas entity. This tactical positioning can help with much easier entry right into global markets, promoting wider company reach and prospective client base expansion. Offshore entities also profit from potentially even more favorable organization legislations that could supply less administration and higher flexibility in business administration and procedures.

Moreover, diversification via overseas procedures can reduce risk by spreading out properties across different regions, thereby securing the organization from local financial instabilities or market variations. These calculated benefits underscore why numerous companies seek offshore possibilities.

Typical Challenges and Solutions in Offshore Company Development

While overseas business formation provides numerous strategic advantages, it likewise introduces an array of challenges that require cautious monitoring. Offshore businesses should understand their tax obligations in several jurisdictions to stay clear of legal consequences and optimize tax obligation performances.

One more significant difficulty is the potential for reputational dangers. The perception of overseas tasks can often be unfavorable, suggesting tax obligation evasion or underhanded habits, even when operations are clear and legal. To counter these challenges, organizations should buy seasoned lawful guidance accustomed to neighborhood and international legislations. Engaging with reliable neighborhood companions and consultants can additionally supply very useful understandings and aid in preserving conformity. Clear operations and clear communication are essential to guarding track record and making sure long-lasting success.

Conclusion

To conclude, developing an offshore service offers significant strategic benefits including go to this web-site tax obligation advantages, privacy, and accessibility to worldwide markets. However, choosing the appropriate jurisdiction and browsing the complex legal landscape require careful consideration and frequently professional advice. While difficulties such as regulatory analysis and reputational dangers exist, with the best approach and conformity, the benefits of overseas incorporation can dramatically surpass these hurdles, supporting service development and global diversification.

Exploring the world of overseas service formation uses appealing critical advantages for business owners, consisting of prospective tax obligation advantages, privacy, and accessibility to worldwide markets.While overseas business development provides investigate this site many strategic advantages, it additionally introduces an array of difficulties that require cautious monitoring. Offshore organizations should understand their tax obligation responsibilities in several jurisdictions to optimize and avoid legal repercussions tax effectiveness.

In final thought, forming an offshore company offers substantial calculated advantages consisting of tax advantages, personal privacy, and access to international markets - Offshore Business Formation. While challenges such as regulatory scrutiny and reputational risks exist, with the ideal technique and compliance, the benefits of offshore unification can substantially surpass these hurdles, supporting service growth and worldwide diversification

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Tiffany Trump Then & Now!

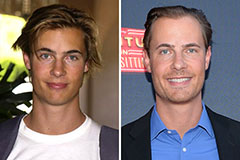

Tiffany Trump Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now!